UI/UX in fintech products is more than aesthetics. It’s the backbone of user engagement, trust and satisfaction.

Suppose a fintech app has complex navigation or unclear instructions. No matter how innovative its features are, users will likely abandon it if they struggle to complete basic tasks.

For instance, a user wants to transfer funds or apply for a loan. What if the interface is confusing or slow? It leads to frustration and trust issues, and they might move to a competitor.

That’s why UI/UX isn’t just about looking good. It’s about creating intuitive, seamless experiences that keep users coming back. But how do you achieve this?

Explore our blog on the critical role of UI/UX in fintech products design and its competitive advantages.

Let’s begin by understanding the meaning of UI/UX design.

Understanding UI/UX Design for FinTech

UX design creates smooth transactions. It connects users with digital products effectively. Good design makes everything easier. It focuses on making products usable and accessible for everyone.

When users enjoy your fintech product, satisfaction grows. They stay loyal. Your business benefits from this relationship in several ways:

- Fewer costly errors occur when interfaces are intuitive

- Customer support needs decrease dramatically

- Users complete transactions faster, improving efficiency

However, competition is on the rise and your fintech product design needs to stand out. Plus, it makes your product attractive in a crowded market. Follow the below points for effective fintech app design:

- Clear step-by-step instructions

- User-friendly navigation systems

- Helpful feedback at each stage

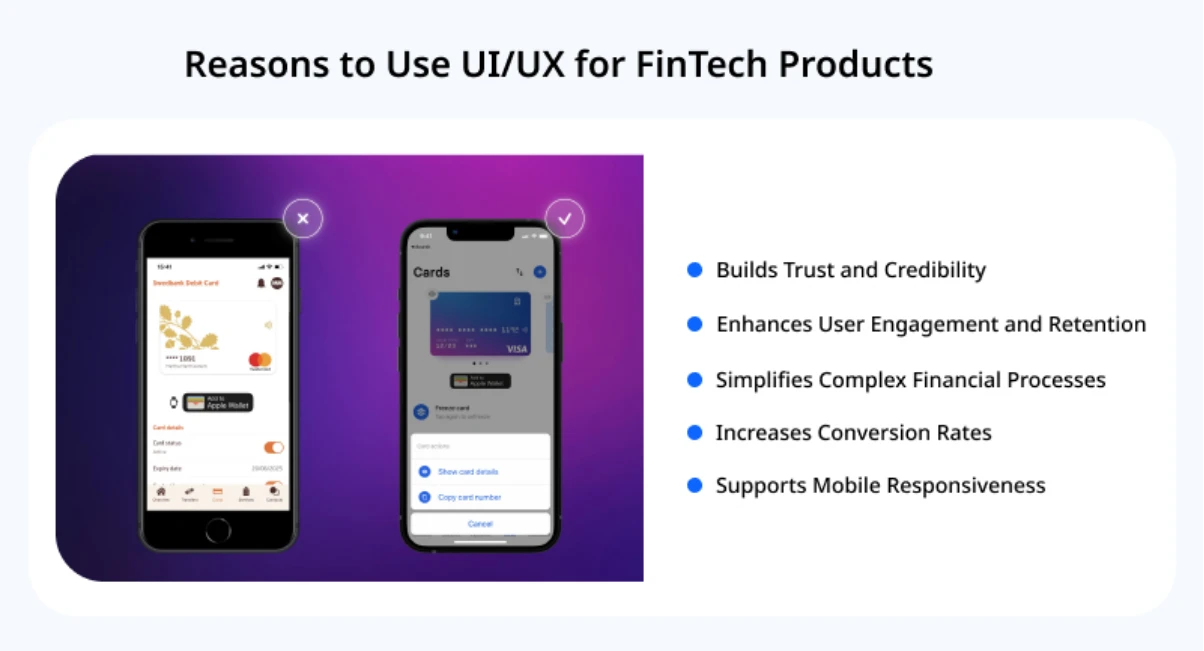

Why is UI/UX Critical for FinTech Products?

In the growing fintech industry, delivering a smooth and engaging user experience is essential. A well-defined fintech app design can directly impact how customers interact with your product. Let’s discuss the importance of UI/UX design for fintech products:

Builds Trust and Credibility

In the fintech industry, trust is crucial as customers' sensitive financial information. A well-thought-out fintech product design with easy navigation, clear information and a secure interface reassures users that their data is safe.

It includes:

- Clear labeling of buttons and actions

- Easy access to security settings and features

- Transparent information about data privacy policies

Enhances User Engagement and Retention

Higher retention rates result from user-friendly design, which motivates customers to interact with the product more frequently. Fintech solutions may retain users by emphasizing a smooth and enjoyable user experience.

Here’s how:

- Smooth navigation across different features

- Quick access to key financial tools and insights

- Customizable dashboards to match user preferences

Simplifies Complex Financial Processes

FinTech apps help people manage money better. But many users don't understand complex financial technology, so your app design must be super simple. A good FinTech mobile app makes it easy. When people open your app, they should know what to do without reading instructions or calling support.

It includes:

- Clear instructions and tooltips for financial actions

- Simplified sign-up and login processes

- Intuitive step-by-step guides for complex transactions

Increases Conversion Rates

A positive first impression impacts whether or not users decide to utilize your fintech product. With an attractive and user-friendly fintech app design, new customers feel confident and at ease using the product, increasing conversion rates.

It involves:

- Visually attractive design elements

- Easy-to-find call-to-action buttons

- Clear and engaging onboarding experience

Supports Mobile Responsiveness

Mobile usage has increased with the available mobile-friendly apps. Your fintech product design must work well on phones and tablets. These mobile-friendly apps help customers use your services wherever they are.

Here’s how:

- Adaptive layout for different screen sizes

- Fast load times for mobile transactions

- Touch-friendly navigation and controls

Advantages of Prioritizing UI/UX in FinTech

Prioritizing UI/UX design in FinTech can significantly affect how customers perceive and use a product. It improves user satisfaction and optimizes overall business performance.

Below are the key advantages of prioritizing fintech app design:

Improves Customer Satisfaction

A smooth and intuitive interface produces an outstanding client experience, directly translating into increased satisfaction. The customers will be satisfied and have more trust in the platform when they find it easy to:

- Navigate

- Access Services

- Perform Transactions

For example, a mobile banking app's streamlined login procedure, user-friendly dashboard and instant access to transaction history can ease customers' frustration and provide them with a greater sense of financial control. Therefore, users are more inclined to give the app a favorable rating and suggest it to others.

For example, a banking app that's easy to use makes customers happy. People who can log in quickly without any issues feel satisfied with the bank's services. Think about what customers want:

- Quick logins that work every time

- A simple dashboard showing money at a glance

- Easy access to see where the money went

Reduces Customer Churn

A poor user experience can drive users away, leading to high customer churn. Consult with UI/UX design firms to keep users interested and reduce the chances of customers switching to competitors. Customers who believe a well-designed experience meets their demands are more likely to stick to a product.

For example, a clean, intuitive design for a peer-to-peer lending platform that makes it easy to:

- Track loan statuses

- Interest rates

- Payment schedules to significantly reduce frustration

A user-friendly interface can make users feel more confident in using the platform long-term, preventing them from abandoning it in favor of simpler alternatives.

Improves Operational Efficiency

A good fintech design practice helps internal operations run more smoothly. A well-designed platform improves workflow efficiency, lowers user errors and decreases the amount of support tickets. This results in fewer operational bottlenecks and more efficiency for the fintech company.

For example, in an investment management app, a simple, intuitive design minimizes the chances of user errors for setting up:

- Accounts

- Transferring funds

- Viewing investment portfolios

As a result, there are fewer support calls and questions, which helps the business run more efficiently and allocate resources.

Facilitates Better Decision-Making

A well-designed user interface/user experience (UI/UX) assists consumers in making informed decisions by providing complicated financial data. Users are more likely to make confident decisions when they can clearly understand their options and possible results.

For example, a fintech app that provides investment alternatives can display the below details using data visualization tools like interactive charts and graphs:

- Market trends

- Dangers

- Possible returns

The software enables users to make wise investment decisions without requiring in-depth financial expertise by providing this data in an approachable manner.

Increases User Confidence

Prioritizing UI/UX ensures a smooth and safe user experience, increasing confidence and trust in the platform. Users who believe the app is reliable and user-friendly are more likely to engage regularly.

For example, a digital payment app providing:

- Instructions for transactions

- Security features

Reassures users that their money and data are safe. This method of IT solutions & services in FinTech builds trust and encourages them to use the platform for more significant and frequent transactions.

Helps in Customer Retention

Prioritizing FinTech technology app design greatly improves customer retention by delivering smooth, pleasurable and effective user experiences. Customers who find the interface intuitive and easy to use are more likely to stick with a product and continue using it.

For example, consider a mobile banking app that provides:

- Seamless two-step money transfers

- Simple instructions

- Immediate transaction confirmations

If users believe the existing app makes their financial tasks easy and stress-free, they are less inclined to switch to another one.

Enhances Brand Perception

A fintech product with an appealing and functional UI/UX enhances the brand perception. Customers associate the smooth experience with professionalism, reliability and trustworthiness, boosting the brand's reputation.

For example, a digital wallet that presents the company as innovative and customer-focused with its:

- Simple layout

- Fluid animations

- Tailored financial insights

The brand perception makes the company stand out and attracts more customers in a crowded market.

Best Practices for FinTech UX Design

To deliver an exceptional Fintech app design, it is crucial to consider user needs, industry standards and regulatory compliance. Here are the below fintech design best practices for a better approach:

- Conduct user interviews and surveys to understand user needs, preferences and pain points.

- Use usability testing to identify app issues and refine the design based on user feedback.

- Employ an iterative design process to improve and align with user expectations continually.

- Establish a cohesive visual identity with consistent color schemes, fonts and branding elements.

- Ensure iconography and typography are clear, recognizable and uniform across platforms.

- Maintain design consistency across devices for a seamless user experience.

- Provide clear, actionable error messages to help users understand and fix issues.

- Optimize app performance with faster load times, efficient data caching and lightweight assets.

- Use smooth animations and transitions to enhance interactivity without compromising speed.

- Proactively anticipate errors with real-time validation and helpful input guidance.

To Conclude

In FinTech product design, offering a seamless and intuitive user experience is crucial to gaining and retaining customers. Poor design can make even the best financial products challenging to navigate, leading to frustration and a loss of trust.

With the right UI/UX design, fintech companies can transform complex processes into simple, practical solutions that attract users and keep them engaged. A smooth interface helps build trust, encourages adoption and ensures long-term customer satisfaction.

If you’re unsure where to start, don’t worry. Hire UI/UX designers to guide you through the process, ensuring that your FinTech products meet user expectations and give you a competitive edge in the marketplace.