ROAS Vs. ROI: Key Metrics for Advertising and Investment Efficiency

What1 is ROAS?

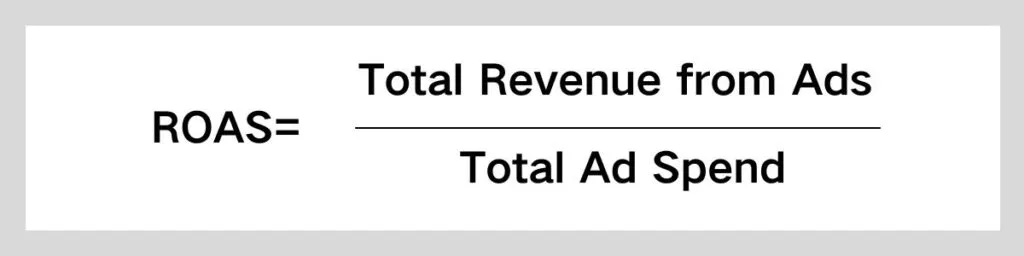

ROAS, or Return on Ad Spend, is a metric used to measure the efficiency of advertising investments. It shows how much revenue is generated for every dollar spent on advertising. ROAS can be used to evaluate the effectiveness of individual ad campaigns and compare the efficiency of different advertising channels or strategies.

Application Scenarios

- Ad Effectiveness Evaluation: Companies can use ROAS to assess the performance of various ad campaigns and choose the most effective advertising strategies.

- Budget Allocation: Based on ROAS, companies can allocate their advertising budget more efficiently, directing more resources to high-return channels.

- Ad Optimization: By analyzing ROAS, companies can adjust ad content, target audiences, and timing to improve ad efficiency.

Advantages

- Intuitive and Understandable: ROAS presents the relationship between ad spend and revenue in a straightforward ratio.

- Easy Comparison: ROAS simplifies the comparison of different ad campaigns or channels, helping companies quickly identify the most effective ads.

- Decision Support: ROAS provides quantifiable data support, aiding companies in making better advertising investment decisions.

Limitations

- Short-term Focus: ROAS primarily focuses on short-term returns, potentially overlooking long-term brand building and customer loyalty.

- Cost Overlook: It does not consider other related costs like product or operational expenses, which are necessary for a comprehensive return analysis.

- Single Metric: ROAS is just one metric and cannot fully represent the overall effectiveness of an advertising campaign, requiring other metrics (e.g., brand awareness, customer satisfaction) for comprehensive evaluation.

What is ROI?

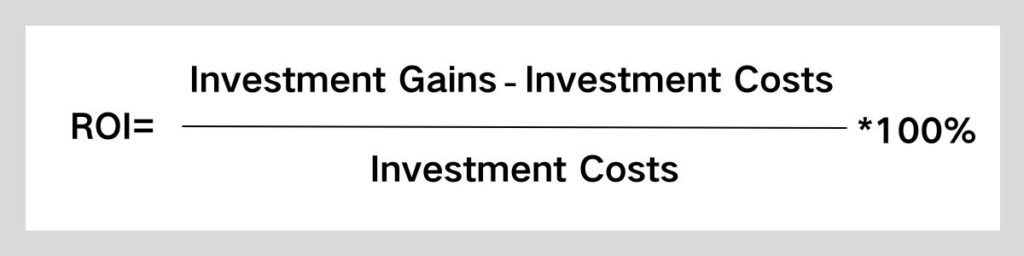

ROI, or Return on Investment, is a metric used to measure the efficiency of an investment by comparing the gains from the investment to its cost. ROI can be applied to various types of investments, including stocks, bonds, real estate, and ad campaigns.

Application Scenarios

- Investment Decision: Individuals or companies can use ROI to evaluate expected returns when deciding whether to invest.

- Investment Performance Evaluation: After an investment ends, ROI can be calculated to assess its actual effectiveness.

- Investment Comparison: Comparing the ROI of different investment projects helps select the optimal investment plan.

Advantages

- Versatility: ROI is a universal financial metric suitable for evaluating all types of investments.

- Simple and Understandable: ROI is expressed as a percentage, directly reflecting the investment returns.

- Decision Support: ROI provides quantifiable data support, helping investors make more informed decisions.

Limitations

- Time Value Neglect: ROI does not consider the time value of money, meaning future earnings are not as valuable as current earnings.

- Single Metric: ROI is a simplified metric that cannot capture the full risk and complexity of investments.

- Short-term Focus: ROI usually focuses on short-term returns, potentially overlooking the long-term value of investments.

How to Calculate ROAS?

How to Calculate ROI?

Investment gains refer to the net earnings from the investment, including capital appreciation and income such as interest or dividends.

ROAS Vs. ROI

Despite both being efficiency metrics, ROAS and ROI are used in different contexts and serve different purposes. It is crucial to choose the appropriate metric based on specific goals and needs.

Measurement Scope

- ROAS is specifically for measuring the effectiveness of advertising campaigns, focusing on the relationship between ad spend and revenue generated by the ads.

- ROI is a broader financial metric used for assessing the efficiency of any type of investment, including but not limited to advertising, stocks, bonds, real estate, etc.

Calculation Method

- ROAS focuses on the ratio between ad spend and the direct sales revenue generated by the ads.

- ROI involves the total investment cost and the overall returns from the investment, including capital appreciation and other forms of income.

Target Audience

- ROAS is primarily used by marketers and advertising professionals who are concerned with how much sales revenue their ad spend can generate.

- ROI is used by a wider range of business decision-makers who focus on overall investment returns, including capital gains and other forms of revenue.

Time Span

- ROAS is typically used to evaluate short-term ad campaigns, such as specific ad series or campaign periods.

- ROI can be used to assess the effectiveness of long-term investments, considering the entire investment period from inception to exit.

Risk Consideration

- ROAS calculation generally does not include risk assessment, focusing mainly on direct revenue.

- ROI evaluation may incorporate risk factors since investment returns often correlate with risk levels.

Impact on Decisions

- The level of ROAS directly influences ad budget allocation and strategy adjustments.

- The level of ROI affects overall investment decisions and resource allocation, including capital deployment and withdrawal.

Other Factors

- ROAS mainly focuses on direct sales revenue, potentially neglecting the long-term impacts of ads on brand awareness and customer loyalty.

- ROI may consider more factors such as market conditions, economic environment, and competitive landscape for a more comprehensive investment analysis.

How to Improve ROAS?

- Combine with Other Metrics: Use ROAS along with other marketing metrics (e.g., brand awareness, customer retention rate) for a more comprehensive evaluation.

- Long-term Tracking: Monitor the long-term impact of ad campaigns on sales and brand value, not just short-term effects.

- Segment Analysis: Conduct detailed analysis of different ad channels, target audiences, and ad content to more precisely evaluate and optimize ad strategies.

How to Improve ROI?

- Consider Time Value: Use metrics that account for time value, such as Net Present Value (NPV) or Internal Rate of Return (IRR), to supplement ROI.

- Risk Assessment: Incorporate risk assessment metrics like standard deviation or beta coefficient to evaluate investment risks.

- Long-term Perspective: Consider long-term benefits and impacts of investments, not just short-term ROI.

FAQs

What is a good ROAS?

Generally, a ROAS above 1 is considered positive, indicating that ad-generated revenue exceeds ad costs. Even a ROAS below 1 might be acceptable in certain cases, especially if the ad campaign aims for long-term goals like brand building or customer relationship development.

Is ROAS better than ROI?