Men Outspending Dogs? Decoding the New Trends in Consumption

In 2018, during a public talk, Marco Yuan, co-founder and CEO of the Angel Investor Center, ranked the consumer market values as follows: Teenage girls > Children > Young women > Elderly > Dogs > Men. And this isn't just a China thing—it's a global trend.

This ranking about spending power went viral online and has been jokingly referenced from time to time, leading to the viewpoint that "men spend less than dogs." The idea being that men just need their wife's old phone, wear their wife's discarded pajamas at home, maybe a thermos and some goji berries—no need for men to spend much. Even ad marketing data from BigSpy confirms it: over 70% of ads target women, covering fashion, shoes, makeup, and more. Ads for children and pets also surpass those targeting men.

But in recent shopping festivals, the ad focus on men significantly increased, surpassing even the pet-related ad placements for the first time. Could this be the rise of "his economy"?

Men's spending power exceeds dogs for the first time.

According to Tmall's latest Double 11 shopping festival data, the top three purchases by male consumers were road bikes, gaming products, and outdoor jackets. Sales of road bikes increased by 305%, gaming products by 114%, and outdoor jackets by 90%. As for the "new three treasures" for pet (dog) consumption this Double 11, sales of full-price dog baking food increased by 85%, dog milk powder by 74%, and freeze-dried dog snacks by 58%.

Comparatively, the rise in men's "new three treasures" far surpassed the pet (dog) "new three treasures," sparking this trend.

According to Tmall's latest Double 11 shopping festival data, the top three purchases by male consumers were road bikes, gaming products, and outdoor jackets. Sales of road bikes increased by 305%, gaming products by 114%, and outdoor jackets by 90%. As for the "new three treasures" for pet (dog) consumption this Double 11, sales of full-price dog baking food increased by 85%, dog milk powder by 74%, and freeze-dried dog snacks by 58%. Comparatively, the rise in men's "new three treasures" far surpassed the pet (dog) "new three treasures," sparking this trend.

From City Walk to City Ride, this Double 11 saw a doubling in sales of "complete bicycles," with male users' growth almost 100% higher than the previous year. In terms of gaming, brands like Wolf Spider, VGN, and Player Nation saw over 100% growth in transactions in their Tmall flagship stores from October 31st to November 5th. The third spot belonged to outdoor gear, specifically outdoor jackets, contributing 90% of the sales.

People commented online that after seeing the Double 11 sales rankings, men finally outspent dogs. Some even joked that the curse of "men aren't as good as dogs" has finally been broken. This data indicates that men's spending capacity has surpassed that of dogs for the first time, signifying a significant rise in their influence and spending power in e-commerce.

Who said "his spending" is inferior to "her spending"?

Traditionally, discussions on male spending haven't matched the fervor surrounding female spending. However, this doesn't mean men spend less. In fact, male spending has distinct differences that require a comprehensive view from various angles.

Firstly, looking at the profile of "his spending," male consumers, especially the younger generation, are a significant market force. In this era of youthful consumption, particularly among the post-'90s, '95s, and even '00s, these newcomers to the workforce and those on the rise in their careers prioritize value for money, uniqueness, and staying trendy while being mindful of spending. According to QuestMobile's 2023 Men's Consumption Insight Report, as of April 2023, males accounted for 50.5% of total internet users, with almost half from first-tier, new first-tier, and second-tier cities.

Secondly, "his spending" and "her spending" differ markedly in various sectors and categories. In segments like tech, electronics, gaming, investments, entertainment, new energy vehicles, and fitness, men dominate spending. For instance, in the new energy vehicle consumer group, 47.2% are aged 25-35, of which about 71% are male. Men also lead in fitness equipment, smart electronic products, and sportswear purchases.

Thirdly, "his spending" is becoming more diverse, with an accelerated rise in online spending capabilities and a mindset that follows trends. While not as visible as "her spending," male online spending is growing. Their consumption habits show strong interests in information, gaming, and entertainment, primarily in IT, motorcycles, gaming, and automotive communities.

Male consumer behavior aligns with trends, whether through short videos, content platforms like Xiaohongshu (RED), or live streaming, where men also succumb to various influencing factors. Nearly 86% of users on an app known as the male version of Xiaohongshu are under 35.

Is "his economy" about to explode?

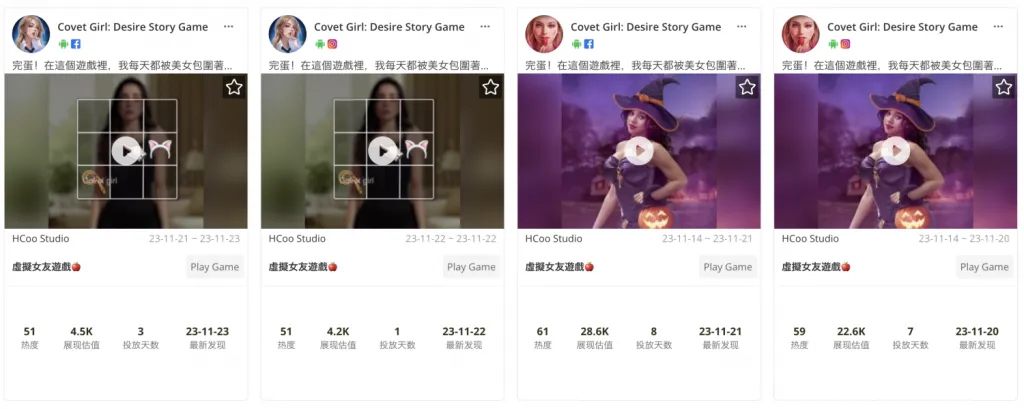

Recently, a real-time interactive love simulation game called "I'm Surrounded by Beauties!" gained massive popularity, captivating over 90% male users.

The game's producer mentioned in an interview that while most focus on emotional consumption for women, there's a market gap for emotional consumption among men through short videos, dramas, and live streams. Ad data from BigSpy confirms this game's ads had over 60,000 impressions within a month, with sustained high engagement.

This game's success highlights the need for emotional value services for male consumers, indicating potential in various segments of male-focused consumption, be it traditional clothing, electronics, gaming, the booming market for new energy vehicles, or the rising trend of men's skincare.

The Suning Financial Research Institute's analyst predicts that the male consumer market is becoming a new consumption frontier. Against the backdrop of rising middle-class demographics, increased mobile internet usage, evolving individualized demands, maturing post-'85 and '90s generations, and a growing population of older single men, "his economy" is set for sustainable long-term growth.

In conclusion, "his economy" is on the fast track, poised to become the next significant consumer trend.