The global casino gaming industry displayed notable developments during Q3 2024, with a total of 1.28 million advertisements deployed across various platforms and regions. This report offers a comprehensive analysis, focusing on regional ad distribution, platform usage, device targeting, ad formats, and landing page strategies. The data provides valuable insights into the evolving dynamics of the casino game advertising landscape, helping stakeholders optimize their marketing efforts for future quarters.

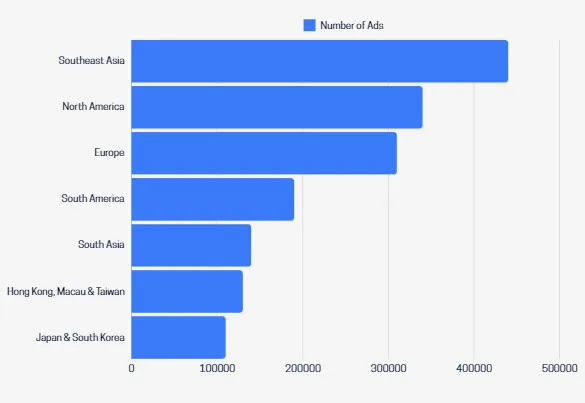

Regional Breakdown of Ad Placements

Advertising activity varied significantly across different regions, indicating targeted strategies to capture market-specific opportunities. Below is the regional distribution:

● Southeast Asia: 440,000 ads (34.4%)

● North America: 340,000 ads (26.6%)

● Europe: 310,000 ads (24.2%)

● South America: 190,000 ads (14.8%)

● South Asia: 140,000 ads (10.9%)

● Hong Kong, Macau & Taiwan: 130,000 ads (10.1%)

● Japan & South Korea: 110,000 ads (8.6%)

The concentration of ads in Southeast Asia suggests heightened competition in fast-growing markets such as Vietnam, Indonesia, and the Philippines. North America and Europe remain strong, driven by mature online gaming segments and enhanced user engagement through localized promotions.

To receive the full report, please reach out to Susie at [email protected].

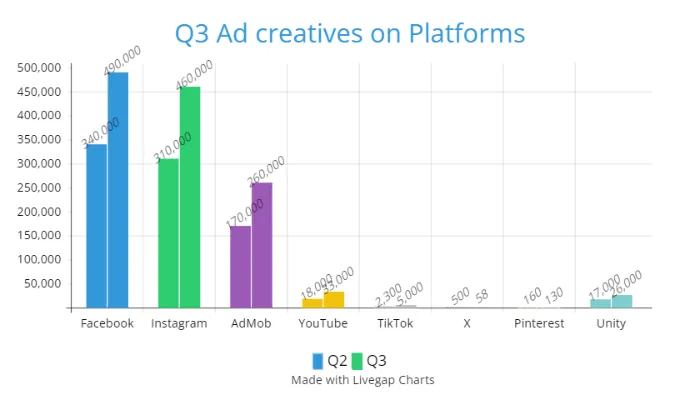

Advertising Channels: Preferred Platforms

Casino advertisers focused their budgets across several social media and ad networks to enhance brand reach and conversion rates:

● Facebook: 490,000 ads (38.3%)

● Instagram: 460,000 ads (35.9%)

● AdMob: 260,000 ads (20.3%)

● YouTube: 33,000 ads (2.6%)

● TikTok: 5,000+ ads (0.4%)

● X(twitter): 500+ ads (~0.04%)

● Pinterest: 160+ ads (~0.01%)

● Unity: 26,000 ads (2.1%)

Facebook and Instagram account for 74.2% of all placements, underscoring the importance of visual engagement and audience targeting. AdMob’s significant share points to the sustained focus on mobile-first strategies, while platforms like YouTube and TikTok are being leveraged for video campaigns targeting younger demographics.

Device Usage: Advertising Across Platforms

The distribution of ads by device highlights a clear preference for mobile-friendly formats:

● Android: 570,000 ads (44.5%)

● iOS: 220,000 ads (17.2%)

● Progressive Web Apps (PWA): 420,000 ads (32.8%)

The dominance of Android reflects its larger market penetration, especially in Asia and Latin America. Meanwhile, PWAs continue to gain traction, offering seamless user experiences without requiring app installations, an essential factor in user acquisition strategies.

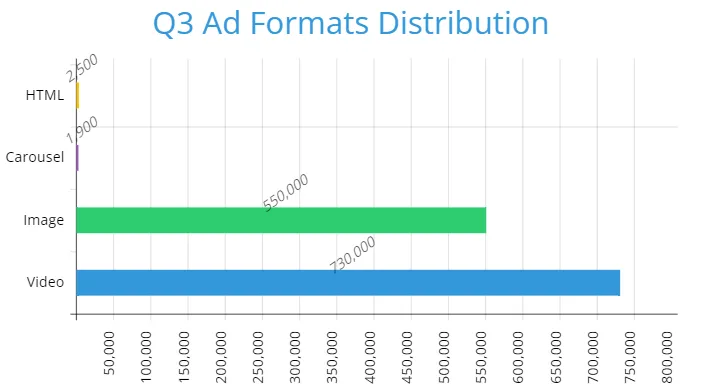

Ad Formats: Creative Types and Trends

Creative diversity remains crucial to capturing audience attention and improving click-through rates. Below is the breakdown by format:

● Video: 730,000 ads (57%)

● Image: 550,000 ads (42.9%)

● Carousel: 1,900+ ads (~0.15%)

● HTML5: 2,500+ ads (~0.19%)

Video ads dominate the landscape, indicating a shift towards dynamic and immersive experiences that engage viewers longer. Real-person ads, leveraging influencers or spokespersons, reflect the need for authenticity and trust-building among audiences.

Landing Page Optimization: Focus on Conversions

Advertisers utilized different landing page strategies to maximize conversions. The breakdown is as follows:

● Game App Downloads: 630,000 ads (49.2%)

● Web-to-App (W2A) Campaigns: 650,000 ads (50.8%)

The near-equal split between app-based and W2A strategies suggests a dual approach: promoting app downloads while also leveraging web touchpoints to initiate app installations. This strategy ensures seamless transitions across platforms, enhancing the customer journey and conversion rates.

Strategic Takeaways for Q3 2024

The Q3 2024 data highlights several key trends in the casino game advertising landscape:

- Regional Focus: Southeast Asia, North America, and Europe led in ad placements, signaling both growth opportunities and market saturation.

- Video Ads Dominate: The preference for video formats reflects the importance of immersive content in capturing attention and driving engagement.

- Balanced Landing Page Strategies: The combination of game app downloads and W2A campaigns ensures broad reach and higher conversion potential.

As competition intensifies, casino game advertisers must stay agile, leveraging platform trends, creative formats, and seamless user journeys to maintain an edge. By refining their strategies based on these insights, industry stakeholders can optimize future campaigns to meet evolving market demands and drive sustainable growth.

To receive the full report, please reach out to Susie at [email protected].