Game Developer’s Guide to the Chinese Market – PART2 – A step by step guide to the market

This article is jointly published by the The Polish Institute in Beijing and Indie Games Foundation Poland. This is the second part.

2.1. STEP 1: PC/Console Games VS Mobile

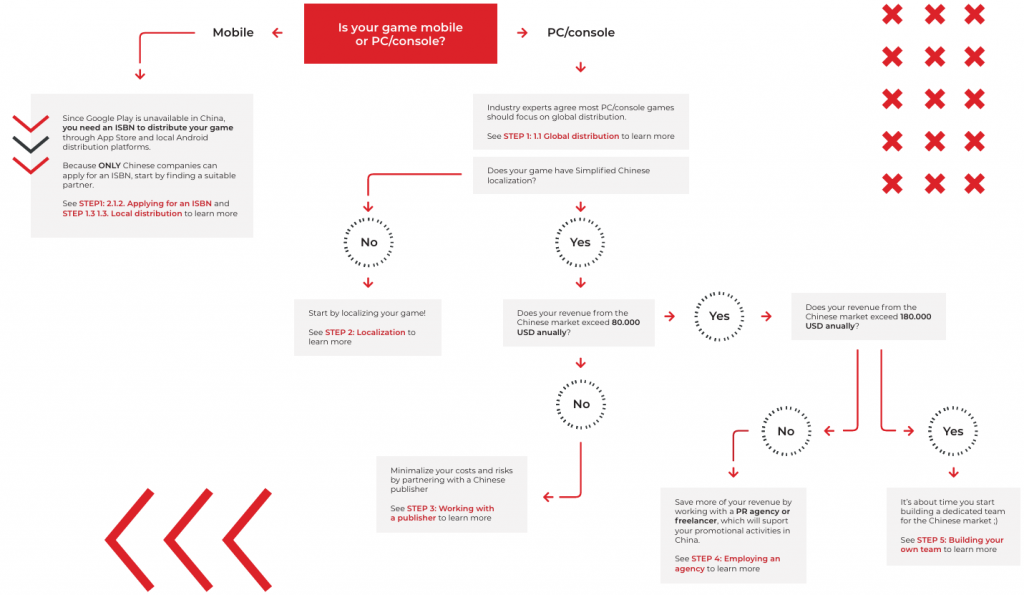

While circumstances vary from one title to another, and risks and opportunities are subject to multiple outside factors, experiences shared by hundreds of gamedev studios attempting to distribute and promote their products in China make it possible to compile a "step by step" guide to the market. However, the following guide should be considered a list of suggestions, inferred from successful market practices, rather than a strict set of rules to follow.

The primary factor in determining a publishers approach towards the Chinese market is the game platforms their product is available on. While every game is different and may present its publisher with unique opportunities, the general agreement among industry experts

is that PC/console games should focus on global distribution(ideally supported by local PR and marketing activities), while mobile games need to apply for an ISBN required for local distribution.

2.1.1 Global distribution

If you're a PC/console game publisher, chances are you're already selling your games in China, without even knowing it. Chinese players often buy games through global distribution channels - while Epic Store and GOG require access through a VPN, STEAM Global is usually available without such difficulties.

STEAM remains the most popular global game distribution platform in China to date. As previously mentioned in PART 1, 2.1, there are roughly 55 million MAUs, which use Simplified Chinese as their preferred language on STEAM Global. And though talks continue about

the global version of STEAM being replaced by STEAM China at some point in the future, no one is able to tell when or if that will happen.

Similarly, since local versions of PlayStation Store, Microsoft Store and Nintendo eShop offer a limited number of games (selling only those titles, which obtained an ISBN), players access overseas versions of the stores in order to gain access to more titles - usually choosing the Hong Kong region when buying games. While it's hard to estimate the exact number of such players, Niko Partners estimates the number of console gamers in China at 16.7 million(as mentioned in detail in PART 1, 2.2).

It is therefore crucial that PC/console game publishers ensure their games support Simplified Chinese localization across all distribution platforms and regions, otherwise Chinese players might either skip the game altogether, or choose to download a pirated copy of the game with Chinese localization.

2.1.2 Applying for an ISBN

Global distribution is unfortunately not a viable option for mobile game publishers - Google Play is unavailable in Mainland China, and App Store requires publishers to provide an ISBN number before a product can be made available for Chinese users. Therefore, mobile game publishers need to apply for an ISBN and opt for local distribution.

Under Chinese law, games are considered a publication, and fall under special supervision of the State. ONLY Chinese companies can apply for an ISBN necessary to publish a game in Mainland China. Even foreign companies running an office or subsidiary in China CANNOT apply for an ISBN. Therefore, every foreign company needs to start by finding a local partner, who will submit the ISBN application to the National Press and Publication Administration (国家新闻出版署) on their behalf.

Cooperation with a local publisher shouldn't be treated as an unpleasant necessity though - a good partner will help you with localization, as well as marketing and promotion on local gaming and social media, often sharing the costs of such activities. Chinese players usually cannot access Facebook, Instagram or X, so without experience with Chinese social media you won't be able to reach out to your potential players. The right partner will help you find your way on the market.

Since China doesn't have an age rating system similar to PEGI or ESRB, generally speaking all games applying for an ISBN must be appropriate for players of all ages. That is why games shouldn't display blood or nudity or portray prohibited content such as drugs, gambling or organized crime. Furthermore, all game content must be consistent with the constitution and laws of the PRC, i.e. cannot threaten the security, unity or positive image of the Chinese state, or promote moral attitudes inconsistent with generally accepted norms. However, as the regulations operate in generalities, it's crucial to find an experienced local partner, who will have the expertise necessary to complete the application successfully.

2.1.3 Local distribution

Obtaining an ISBN might take several months (sometimes even up to a couple of years), and require changing in-game content. However, once your game obtains the ISBN, your partner can arrange the game’s distribution through local platforms. What might seem pretty straightforward at first, is in practice very complicated, as the local distribution market is highly fragmented, both in case of mobile and PC games.

Since Google Play is unavailable in Mainland China, there are dozens of different distribution channels for Android devices, including app stores pre-installed by the device manufacturer (e.g., Oppo, Xiaomi, Huawei, Vivo etc.), general app stores downloaded by users themselves (e.g. Tencent App Store, 360 Games, etc.) as well as dedicated apps aimed directly at gamers rather than casual players, such as TapTap or Maozhua (猫抓) . Of course, Apple product users can download games directly from AppStore.

On the other hand, there's a limited number of local distribution channels for PC games, the most important being Tencent's WeGame platform. According to most recent data from 2020, WeGame has 300 million registered users and 72 million MAU. However, since the platform distributes only those games that have obtained an ISBN, it's offer is highly limited compared to global competitors, such as STEAM or Epic Games Store.

What is more, obtaining an ISBN opens the door to Chinese cloud gaming platforms, which are becoming increasingly popular. Having in mind that many Chinese gamers are high school and university students, who can't afford high-end gaming PCs and laptops, cloud gaming platforms offer them a chance to experience games that they wouldn't be able to play otherwise. There are currently tens of different cloud gaming platforms available in China, operated by many companies including Tencent, NetEase, Huawei etc.

An ISBN also entitles game developers to promote their games through paid adds on social media, such as Weibo or Bilibili. It should be noted however, that it's not entirely possible to target such adds at very precise groups of viewers, such as PC or console gamers, therefore paid marketing campaigns might work better with mobile games, as there's a higher chance they'll reach potential customers compared to PC/console indie games.

2.2. STEP 2: Localization

Despite a strong emphasis on English learning in Chinese schools and households, the overall language proficiency is very low. Very few gamers in China would be able to hold a conversation in English, not to mention keeping track of a game's dialogues and intricate plot. Therefore, while Chinese language localization might not be a priority for mobile game publishers (their products being unavailable for purchase in China prior to them obtaining an ISBN anyway), it is an absolute MUST for PC/console games.

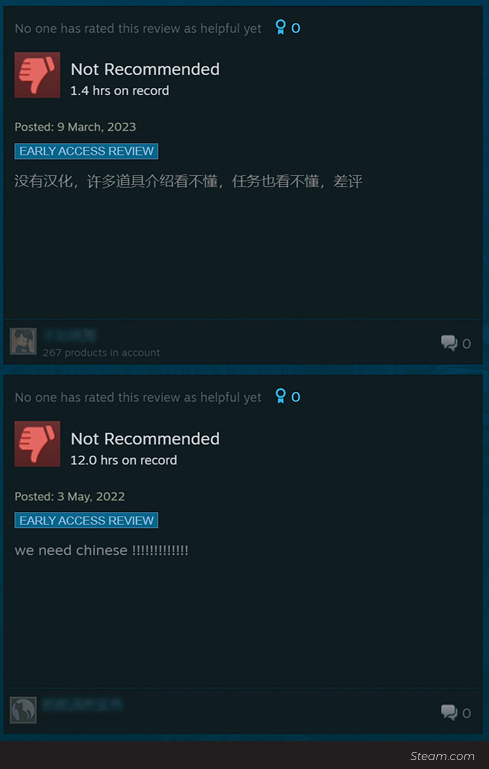

Whether the publisher decides to distribute their games through STEAM Global or local platforms (in cooperation with a local partner), localization into Chinese will be one of the factors determining the game's success. So much so in fact, that one of the most common negative comments on STEAM added by Chinese players is: 没有中文!(No Chinese language!) Chinese players will often leave a game's STEAM page without reading the game description if Chinese is not among the supported languages - therefore even if a game has no in-game text except for the main menu, its product page should indicate Chinese language support as to not scare off potential customers.

2.2.1 Simplified VS Traditional Chinese

Before going further, it's important to first understand the difference between Simplified (usually abbreviated ZHCN), and Traditional (ZHT, ZH-TW or ZH-HK) Chinese. In theory, both are different variants of written Chinese; in practice, the difference between Simplified Chinese and Traditional Chinese could be compared to the difference between American and British English. However, since the majority of Chinese players use Simplified Chinese, localizing the game into Simplified Chinese should be considered a priority.

It's not enough to provide any localization though - Chinese players have high expectations for the quality of translation of foreign games, therefore it's important to ensure quality. Since both, Polish sinologists and Chinese polonists, receive little to no training in video game localization, it might be easier to find individuals and companies experienced in English to Chinese game localization.

Standard fees for English-Simplified Chinese localization vary between 0.06 to 0.12 USD per word. However, lower prices increase the risk of lower quality localization, with some translators having a turnout of 10 thousand Chinese characters per day (roughly around 20 pages of English text). Such translators won't find the time to download and play the game, and are prone to making mistakes in their translations, which Chinese players won't forgive.

2.2.2 Title localization

Another good practice is localization of the game's title. Very few Chinese players can speak any English at all, therefore they might find it hard to memorize a foreign title. Especially those composed of less popular words (e.g., typical for fantasy or science-fiction genres). Adding a Chinese title will make it easier for players to memorize the name, increasing the game's recognizability.

Localized titles should be added not only in the game descriptions on various platforms, but also in the game properties, to make sure players can use the Chinese title in the platform's search engine to find the game they're looking for. Publishers and developers can enter localized product names on STEAM in the General Application Settings of the Steamworks Settings section for their app.

2.2.3 Chinese VO

While the decision to add Chinese subtitles should be a "no-brainer", some publishers might consider recording a full Chinese VO for their games. While it's not entirely possible to calculate the impact of the VO on sales, an increasing number of games, especially AAA titles, support Chinese VO on release (e.g., Cyberpunk 2077 or Dying Light 2).

Opinions among industry insiders are divided: Brandy Wu, Overseas Business Developer at X.D. Network, stated in an interview with Chris Priestman that Chinese subtitles are a better choice, as Chinese players are used to listening to the original English or Japanese VO when playing a game. In contrast, according to Iain Garner, former Director of Global Developer Relations and Marketing at Another Indie, and Luis Wong of INDIENOVA, Chinese gamers appreciate the extra effort that went into preparing the Chinese VO. Most agree, however, that well-prepared subtitles are a better choice than a poorly prepared VO.

Since foreign companies rarely have proper Chinese voice talents, they often outsource the recordings to their partners in China. Therefore, in order to save resources, publishers can try reaching out directly to Chinese recording studios. The average price among credible recording studios in China varies between 70 to 100 CNY per recorder sentence.

2.2.4 Adaptation of game features

Localization refers not only to the translation of in-game texts, but also adaptation of the game to the needs of the Chinese market, e.g. by removing inaccessible features or adding local payment methods available only to Chinese players (in case of F2P titles). Without regular access to certain foreign websites and services, Chinese players might either miss out on particular game features, or even completely fail to run the game.

For example, any hyperlinks to the game's Facebook page or the studio's profile on Instagram will remain inaccessible to Chinese players. Similarly, any Google services, such as ads or CAPTCHA images, necessary to access certain features, will also be inaccessible. As a result, the game client might freeze not being able to connect to the Google server, which will most probably end up in a negative comment left by the Chinese player.

2.2.5 Localization for ISBN

Localization of the game is also an integral part of the ISBN application. In order to obtain an ISBN, a game cannot contain any foreign language texts, including text found on in-game textures, such as road signs, building names or signboards - all of those need to be translated into Chinese.

Games applying for an ISBN are also prohibited from using strong language, e.g., swear words, whether or not the developers consider it an integral part of the game lore. Some translators might have little experience with such localization, therefore publishers should consider leaving the task to their Chinese partners, who have adequate experience in tackling such problems.

However, it should be stressed that these rules apply ONLY to games distributed locally under an ISBN - sticking to the same rules when localizing games available through global platforms (i.e. STEAM, Epic, GOG) might backfire, as some players turn to global platforms to buy original versions of the products available globally, instead of the version available for purchase on local platforms.

2.3 STEP 3: Working with a publisher

Once your game has been localized into Chinese, your next step should depend on the revenue your company earns from the Chinese market on an annual basis. Companies with little to no revenue (average under 80,000 USD annually) can minimalize their costs by entering into a partnership with a Chinese publisher.

Contrary to Western countries, Chinese publishers rarely enter into a partnership early in a game's development. They prefer to sign games with a significant number of STEAM wishlists, focusing their efforts on promoting the game on the local market (promoting games locally does NOT require local distribution, as long as the games are available on global distribution platforms).

The Chinese publisher may take care of the game's localization into Simplified Chinese, register and manage the game's social media accounts (such as Bilibili or HeyBox), interact with your fanbase and reach out to media and influencers, though they'll rarely invest their own funds in the game's development. Their strength lays in their market expertise - to make the most of the market, marketing assets need to be localized, rather than translated, to better suite tastes of Chinese players and encourage them to buy the game.

In this respect, the Chinese publisher's role is more similar to that of Western PR agencies. The difference is that the publisher undertakes all costs of local PR and promotional activities in return for RevShare (Revenue Share). Generally, RevShare commission is 50% of the income generated by the Chinese market, but can vary depending on particular projects.

However, since foreign companies find it hard to verify the credibility of their potential Chinese partners, it might be a good idea to "ask around" when approached by an unknown company. Many Chinese publishers, such as Tencent, NetEase, East2West Games, Whisper Games, Surefire.Games or Coconut Island, have partnered with Polish gamedev companies in the past, so you might want to ask for their experiences and opinion.

2.4 STEP 4: Employing an agency

Companies with an annual revenue from the Chinese market above 80,000 USD, can consider employing a PR agency or a part-time Chinese employee instead of partnering with a Chinese publisher. Usually, PR and promotional activities can increase a game's sales in China by at least 20%. Therefore, if the company already has significant revenue from the Chinese market, it seems viable to reinvest part of this revenue to further increase the sales.

Unfortunately, some global PR agencies combine high prices with little to no expertise on the Chinese market. Therefore, in order to make the most out of your budget, try to find agencies specialized in the promotion of PC/console games on the Chinese market, or reach out to local PR agencies in China. An increasing number of popular Chinese gaming websites offer agency services to overseas gamedev companies on fixed or flat fees, ranging from 2,000 to 3,000 USD per month.

2.5 STEP 5: Building your own team

When a company reaches the final threshold of around 180.000 USD in annual revenue from the Chinese market, it's about time to start building a dedicated team to coordinate and supervise all promotional efforts on the market. The average salary of a Chinese native-speaker with sufficient experience in game promotion ranges from 20,000 to 30,000 CNY (about 2800 to 4200 USD).

A Chinese employee can support and facilitate cooperation with your publisher/agency, unify and focus all messages reaching the Chinese community, as well as establish and maintain personal relations with media representatives and influencers, which are an invaluable asset in Chinese culture. They can also help organize local events, such as gameshows or press showcases. Beyond all, they'll play a pivotal role in establishing your company brand in China.