Repost:Game Developer’s Guide to the Chinese Market – PART1 – The basics

This article is jointly published by the The Polish Institute in Beijing and Indie Games Foundation Poland. This is the first part.

1.1 Chinese Gaming Market

The past couple of years have been difficult for the world's biggest gaming market - organizational restructures and a crackdown on the industry over gaming addiction concerns, followed by a months' long freeze of the game approval process, resulted in the first ever decline in the revenue and gamer population in China in 2022.

1.2 Market Segments

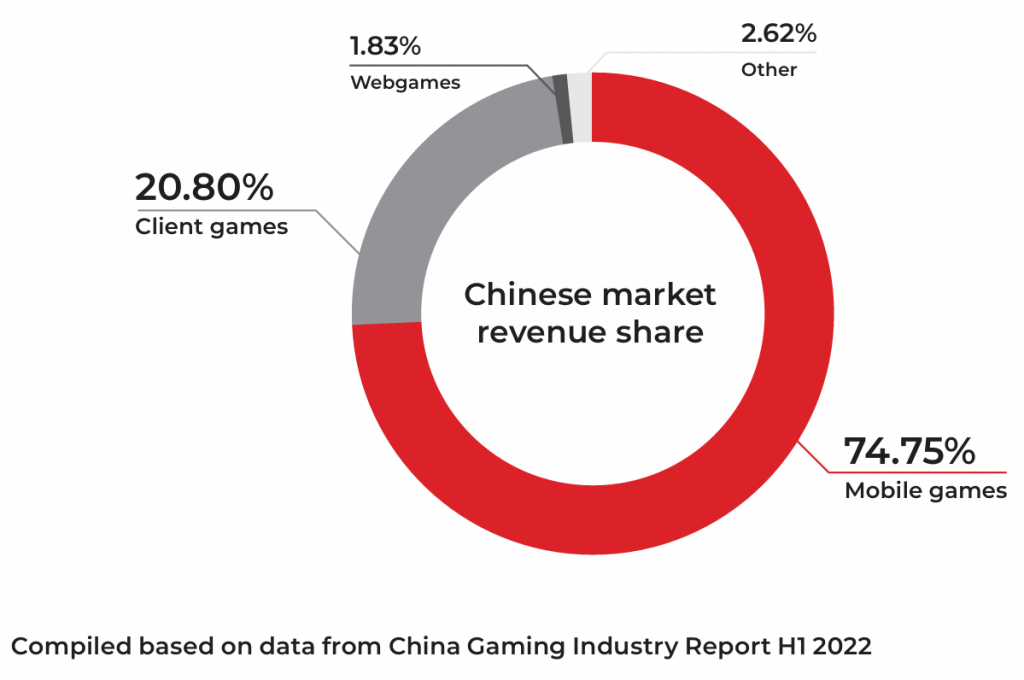

According to the most recent data from the CGIGC China Gaming Industry Report, almost 2/3 of the revenue generated by the Chinese market comes from mobile games, with the remaining 1/3 coming mostly from client games (PC and console games), with marginal input from webgames and other products.

1.2.1 PC Games

Though the CGIGC China Gaming Industry Report suggests the revenue generated by the whole client game segment accounts only for about 21% of the total market revenue, PC games are very popular in China. According to the CHINA PC GAMES MARKET & 5-YEAR

FORECAST REPORT published by Niko Partners, there were 322 million PC gamers in China by the end of 2022, generating a revenue of $14.2 billion.

While the number of Chinese PC gamers amounts to almost half of the Chinese gamer population, they are spread across a multitude of different platforms, often exclusively playing their favorite online games, distributed through local stores. In order to estimate the number of players likely to purchase overseas games available through global distribution platforms, we should look at the number of Chinese users on STEAM Global.

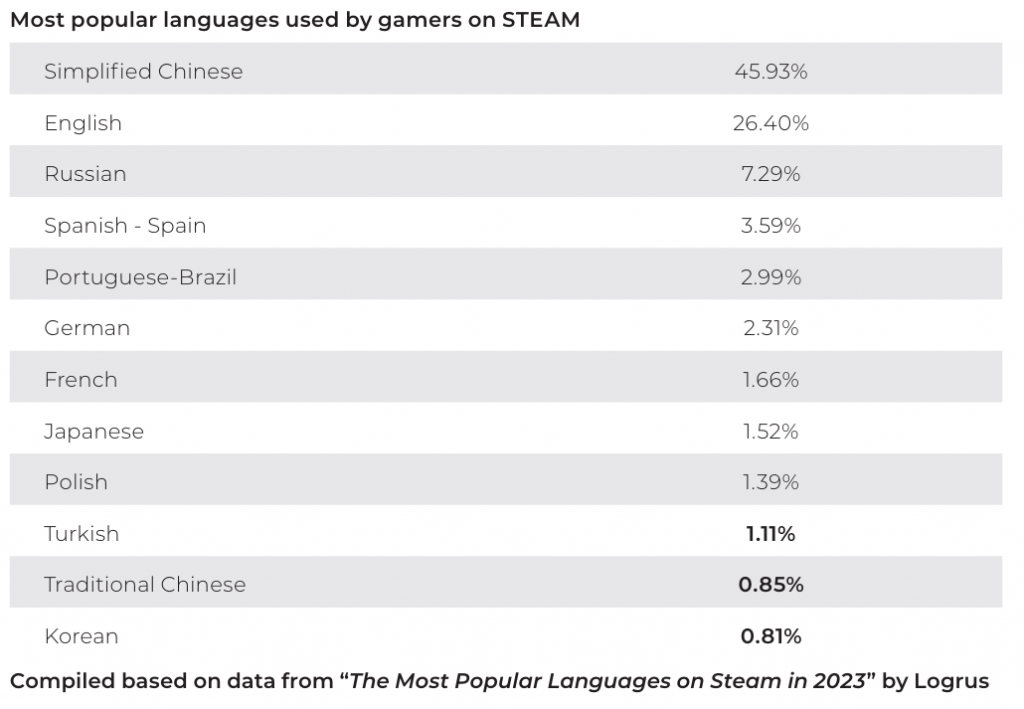

The official number of Chinese MAUs on STEAM amounts to 30 million, however, since many Chinese players use VPNs to connect to the Internet, a more accurate estimate would be the percentage of users running the STEAM client in Chinese, which as of October 2023 amounts to 45,93%.4 With 120 million MAUs5, we can estimate the number of Chinese STEAM players as about 55 million MAUs.

1.2.2 Console Games

In 2000, amid fears they could have “adverse effects” on children and young people, Chinese authorities officially banned the distribution of consoles and console games in Mainland China6. While they remained available on the grey market, the ban and the unavailability of products in legal circulation had huge impact on the Chinese console gaming segment.

China’s Ministry of Culture officially lifted the ban in January 2014, and the first console to debut on the Chinese market was Microsoft’s Xbox One, which didn’t hit the shelves until September of that year. Sony followed in Microsoft’s footsteps a few months later, when it released the PlayStation 4 in March 2015.

Since until then the console game segment existed only on the gray market, accurate data concerning this market segment only reaches as far as 2015. It should be noted though, since local versions of consoles only provide access to games approved for local distribution, many players prefer to import overseas consoles and purchase games from Hong Kong or Japan regional stores to access more games.

According to the CHINA CONSOLE GAMES & 5-YEAR FORECAST REPORT by Niko Partners, there were about 16.7 million console gamers in China by the end of 2022, generating a total revenue of $2.3 billion in hardware and software purchases, both in the general and gray market segments. While console gamers are a comparatively small part of the overall Chinese gamer population, Niko Partners estimate the number of gamers will increase to 23 million by the end of 2027.

1.2.3 Mobile

It doesn’t take much to notice the immense popularity of mobile games in China - take a ride on the Beijing subway, or enter any venue where people have to stand in line for more than a couple of minutes and you'll see people of all ages eagerly playing mobile games to kill time. The number of mobile gamers grew from 90 million in 2012, to over 640 million in 2022, according to the Niko Partners’ CHINA MOBILE GAMES MARKET & 5-YEAR FORECAST REPORT, generating over $30 billion in revenue in the same year.

With that said, the vast majority of China’s mobile gamers are casual gamers, for whom the main source of games are titles pre-installed on their smartphones, or free games available for download through app stores. Unfortunately, as most mobile platforms offer both f2p and premium games, it's hard to estimate how many mobile gamers in China are willing to pay for premium products.

1.2.4 VR and AR

The virtual reality (VR) and augmented reality (AR) segment in China differs from that of the European market, due in large part to the openness of the Chinese to new technologies. According to statista, the AR and VR market in China is projected to reach revenue of $6.6 billion in 2023, with an expected annual growth rate of 11.91%. However, these numbers fall behind estimates from 2018, which shows that the VR and AR segment isn't growing as much as some experts anticipated, with most revenue still generated by hardware, rather than content distribution.

Multiple Chinese VR companies agree that the fastest growing markets for VR and AR in China are professional training facilities and VR cafés, rather than individual players. Often enough Chinese publishers approach overseas VR simulator game developers eager to

distribute their products as professional training materials for vocational schools or training facilities. On the other hand, VR cafés are usually interested in party games that can be played casually by friends spending time together in their venues.

1.2.5 E-Sports

Various sources provide radically different estimates of the size and value of the Chinese e-sports market segment. The 2021 CGIGC China Gaming Industry Report estimated the market’s value at about $20 billion, with a userbase exceeding 480 million. On the other hand, statista estimates the market value in 2023 at $445.2 million, with the number of users projected to reach 253.5 million by 2028. While the differences might be caused by different methodology, they are also an outcome of the quick expansion of the market, which makes it difficult to measure its actual value.

While the boom for mobile e-sports has contributed to quick expansion of the e-sports market, China became one of the leading e-sports nations in the early 2000s, when the Chinese authorities recognized e-sports as a sport. In 2016, the Chinese Ministry of Education added "esports and management" to the list of permitted college majors for Chinese universities, while the Ministry of Human Resources and Social Security (CMHRSS) followed in 2019 by announcing recognition of "e-sports professional" and "e-sports operator" as two new official professions. No wonder China is also home to many world e-sports champions.

1.3 Challenges and Risks

The sheer size of the Chinese gaming market, paired with the high revenue it generates, undoubtedly sounds very tempting, but with opportunities come challenges and risks, which you need to face if you are to achieve success. Although foreign companies have to handle additional legal restrictions to game distribution (see PART 2.1.1), local companies face similar obstacles, including fierce competition, piracy and plagiarism.

1.3.1 Competition

According to data published by statista, over 10,000 games have been released on STEAM every year since 2021. That's an average of almost 30 games per day, which makes it hard to stand out from the crowd, especially for indie game developers. With such fierce competition, even outstanding games can fail to reach their potential audiences without proper marketing and promotion, even more so on less familiar markets.

However, not all of those games make it to overseas players - some are titles developed by and for local markets, including China. While such games are at a disadvantage when competing on international markets, their developers know the respective local markets better. Therefore, when attempting to promote overseas games in China, foreign game developers have to compete with both global blockbusters, and local indie games, developed by Chinese teams for Chinese players.

1.3.2 Imitation games

Some of those games are so-called "shānzhài" or "imitation" games, which verge on the border between inspiration and plagiarism. Copying popular gameplay patterns or motifs is less risky for smaller gamedev teams, being more likely to attract potential investors and publishers. It might also be considered a form of tribute to the original game, especially if it doesn't have Chinese language localization or depicts a strange or unappealing cultural or historical background.

However, thanks to growing interest in the Chinese market, and increasing presence of overseas games on Chinese platforms, combined with simultaneous growth of Chinese publishers' interest in overseas markets, Chinese gamers have higher expectations towards new games, expecting more creativity and innovation. This, in return, encourages Chinese indie game deve

lopers to find their own place in a growing but diversifying market.

1.3.3 Cultural foreignness

Among the biggest challenges overseas companies face when trying to sell and promote their games in China is cultural foreignness, experienced both by the game developers and the players alike. Chinese players come from a different cultural background and might not understand or not relate to things that the developers consider natural and obvious.

The Frostpunk game is a perfect example of how different can cultural perspectives be - the city survival game developed by the Polish 11 bit studios, triggered a debate among Chinese netizens on how societies should be run, and what are the people’s responsibilities when they're facing extinction. Upon completing the game, players view a recap of their choices and are asked the question: The city survived…but was it worth it?

Many Chinese players found the question enraging - on the one hand, they mostly consider video games a form of entertainment and are not used to games questioning their moral decisions, on the other hand, many of them believe that all means are justified as long as they ensure the survival of the society as a whole. Therefore, their experience from playing the game was completely different than that of Western players.

1.4 Trends

With almost 670 million players, discussing general market trends delivers little useful information - just like everybody else, Chinese players like casual games, action games, RPGs and FPS. However, with such a huge gamer population, pretty much every game can find a niche of its own, which can guarantee a good enough profit to justify the additional localization and promotional costs. Therefore, instead of discussing game genres, lets focus on game features, which increase the chances of a game's success.

In an article from 2017, Iain Garner, then Director of Global Developer Relations and Marketing at Another Indie, points out that Chinese players prefer "cute" and "adorable" games with exaggerated characters (typical of the Japanese "chibi" style), such as Lost Castle, as well as games with anime aesthetics, such as ICEY. Luis Wong of INDIENOVA, on the other hand, recalls that while aesthetics reminiscent of Japanese anime are most popular among Chinese gamers, they also appreciate games with a unique graphic style, like Monument Valley and Hidden Folks. Wong also stresses that Chinese gamers rather dislike aesthetics straight out of Western TV shows such as Futurama or Family Guy.

Another key factor to a game's success is whether or not the game supports multiplayer - many Chinese gamers consider games a means of socialization, therefore online co-op is a must for titles wishing to attract greater audiences. Especially if it allows for competition between players, which is an important part of Chinese culture.

However, according to recent research by China indie Game Alliance, years of lockdown under the covid pandemic took their toll on Chinese gamers, who experience increased levels of anxiety and depression. Such players get easily frustrated with challenging games, especially if they don’t include a tutorial, or the tutorial isn’t clear enough. In effect, players are more likely to quit and leave a negative comment on STEAM if the gameplay is too demanding.

Another important cultural difference is humor – Chinese humor relies more heavily on puns and wordplay rather than situational or contextual humor. In other words, certain dialogues or situations considered funny in Western culture, might not pass as funny to Chinese players. To ensure the game’s narrative resonates well in China, companies should put necessary effort into the localization of the game into Simplified Chinese (see PART 2.2).